In summer 2019, I wrote that people were concerned about sustainability and that the planet mattered when they were shopping. But there was a significant gap between intentions and actions. 18 months later, in the middle of a global pandemic, what’s the status? Does sustainability still influence shoppers? Does the gap still exist? Based on an in-depth review of 2020 surveys, the short answer is yes and yes. Let’s drill down into data.

People are more and more concerned about sustainability

During the pandemic, sustainability concerns have persisted – and even accelerated. According to a recent Kantar survey1, climate change remains the number one issue globally for 16.9% of respondents. The second biggest issue is still plastic waste for 14.8% of respondents. And people are not only concerned: half of them have experienced environmental problems firsthand.

Worries are put into perspective by the BCG2: since the beginning of the outbreak, people are more anxious about infectious diseases and environmental issues. Further to that, two-thirds of the people think that health and environmental issues are equally concerning for the world. Kantar confirms that environmental issues keep on being important for most people after COVID-19 and a bit more than one-fifth of them believes those issues are now more critical than ever3.

People want to live, consume and shop more consciously

People are increasingly aware of their impact on the environment and they are willing to act. As revealed by GlobeScan4, a majority of people agree that what’s good for them is often not good for the environment – a surge of 13 pts in one year! And nearly three-quarters of them know the solution: they need to consume less to preserve the environment for future generations – plus 8 pts vs 2019.

People are also considering sustainability when they shop. More than two-thirds of shoppers surveyed by Capgemini in October last year5 declared they would be more mindful in their purchase habits once the pandemic is over – an increase of 3 pts in 6 months. Note that Accenture reports an even higher number: according to a research conducted in June 20206, nine consumers out of ten were planning to make more environmentally friendly, sustainable, or ethical purchases after the COVID-19 crisis!

Some shoppers plan to go as far as switching retailers or brands to align with their values. In that respect, McKinsey pointed out7 that purpose was a reason for shopping at a new (e)store or trying a new brand for a little more than one-fifth of the shoppers. And the Capgemini research mentioned above uncovered that buying sustainable products was making almost two-third of shoppers happy.

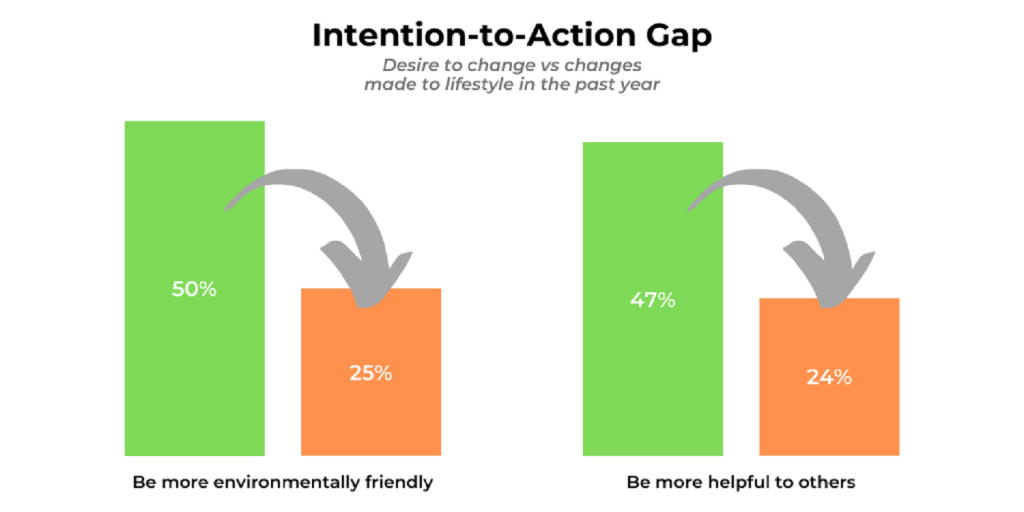

But good intentions do not convert into actions

Many people want to change their way of life but some fail to do so. According to GlobeScan, roughly half of the people have a desire to take care of the environment or help others, but only a quarter has made major changes to their lifestyle. Capgemini indicates that a significant proportion of shoppers (42% precisely) declare they have already changed their purchase preferences based on social, economic, or environmental impact. But globally speaking, 21% of the people surveyed do not want to change or do not care! Further to that, GlobeScan uncovers that more than two-thirds of shoppers have considered buying products from or speaking positively about responsible companies but only half of them have done so.

Why is that? Value has been consistently reported as a key barrier to responsible shopping. For instance, the Conference Board listed8 ‘extra-cost’, together with ‘lack of trust’ or ‘confusion regarding environmental claims’, as the most important barriers to buying brands with better environmental practices. More specifically in the UK, PwC revealed9 that the top 3 barriers to conscious spending were cost (59% of Britons), availability (51%), and lack of time to do research (40%).

Brands, retailers, and governments need to do more to unlock commitment to change

Conscious shoppers want more from brands in terms of product offering and information. According to Accenture, two-thirds of consumers expect companies to create better products and services having a positive impact on society and our planet. And half of the people surveyed by GlobeScan want companies to make it easier to understand which products and services are better for both people and the environment.

But it’s even more important for brands and retailers to bring value to shoppers. Quoting again McKinsey, in the 3rd quarter of 2020, ‘value’ was a reason to switch to a new retailer, store, or website for 55% of the shoppers and to a new brand for 69% of them. Considering the economic and personal finance outlook, value is likely to remain a key purchase criterium for the coming months.

Beyond that, companies and institutions need to accelerate the pace of change. As stated by the BCG, people expect companies to do more to protect the environment; they also want governments to embed that priority in their recovery plans. The former is confirmed by Accenture: one-third of people expect greater business involvement in improving social and environmental outcomes. And the latter is echoed by Kantar: the same proportion of people think that actions to address climate change should be a more pressing priority for governments.

To summarize, people remain concerned about environmental and social issues. They want to live, consume, and shop in more sustainable and responsible ways. But value, trust, and support from brands and governments are critical to encourage and facilitate the adoption of new behaviors.

Sources

1. Kantar. #Who Cares, Who Does? May-June 2020

2. BCG. Global survey on COVID-19 and Environment. May 2020 (pdf).

3. Kantar. Global COVID-19 Barometer Wave 7. July 2020

4. GlobeScan 2020 Healthy & Sustainable Living survey. June 2020 (pdf).

5. Capgemini. Sustainability in Consumer Products & Retail Survey. March 2020 (pdf)

6. Accenture COVID-19 Consumer Research. June 2020

7. McKinsey & Co. Consumer sentiment during the coronavirus crisis. October 2020. Average scores based on data from 8 markets (France, Germany, Italy, Spain, UK, India, China and USA).

8. The Conference Board Global Consumer Confidence Survey. April 2020.

9. PwC UK Purpose survey. July-August 2020.