Every 2 years, I embark on an exploration of the ever-evolving landscape of Sustainability. From a deep dive into data in 2019 to navigating the impacts of the pandemic in 2021, it’s become somewhat of a routine. Now, as we are approaching 2023’s closure, it’s time to make a return with the latest insights, fueled by the most recent research. The good news is that there have been significant shifts in consumer habits, concerns, and perceptions of responsibility regarding sustainability and environmental issues over the past two years. So quite a bit to talk about. Let’s get started.

Climate Change Realities and Consumer Concerns

The global impact of climate change is no longer an abstract concept but a tangible force disrupting consumption habits across diverse societies as highlighted by the latest EY Future Consumer Index. This disruption is not limited to the physical environment; it extends to the collective mindset of individuals. The surge in conversations on social media, with a notable shift from generic weather discussions to explicit references to climate change, suggests a rapid increase in awareness of its impact.

GlobeScan Healthy & Sustainable Living survey emphasizes that people are not just acknowledging climate change; they are experiencing its effects firsthand. The report notes that a tipping point is approaching where half of the global population feels greatly affected by climate change. This underscores the urgency of addressing environmental concerns on a global scale.

The EY research also reveals that combating climate change is the top global sustainability issue, closely followed by health and well-being, affordable and clean energy, clean water, sanitation, sustainable ecosystems, biodiversity, and ending poverty. The interconnectedness of these issues highlights the complexity of the sustainability challenge facing the global community.

The Challenge of Living Sustainably

While a substantial 70% of global consumers express the importance of living sustainably, the adoption of conscious consumerism remains in its infancy according to Nielsen’s Great Divide report. Mintel also indicates in their Global Outlook on Sustainability that, in many cases, consumers are more likely to engage with small-scale lifestyle changes that do not significantly alter their daily lives or consumption habits.

The intention-to-action gap is evident, with almost two-thirds (61%) of the global population lacking the awareness, motivation, and action required to live more sustainably as reported by Nielsen. A significant challenge lies in the fact that most people do not fully understand which actions have the most impact – leading to a sense of helplessness for GlobeScan.

Nielsen’s segmentation of sustainability mindsets, ranging from skeptics to evangelists, provides valuable insights into consumer motivations and readiness for sustainable consumption. I encourage you to read the report – a link is provided at the end of this post. Speaking about segmentation, a notable trend identified by GlobeScan as well as Mintel is the growing cohort of people seeking both health and sustainability.

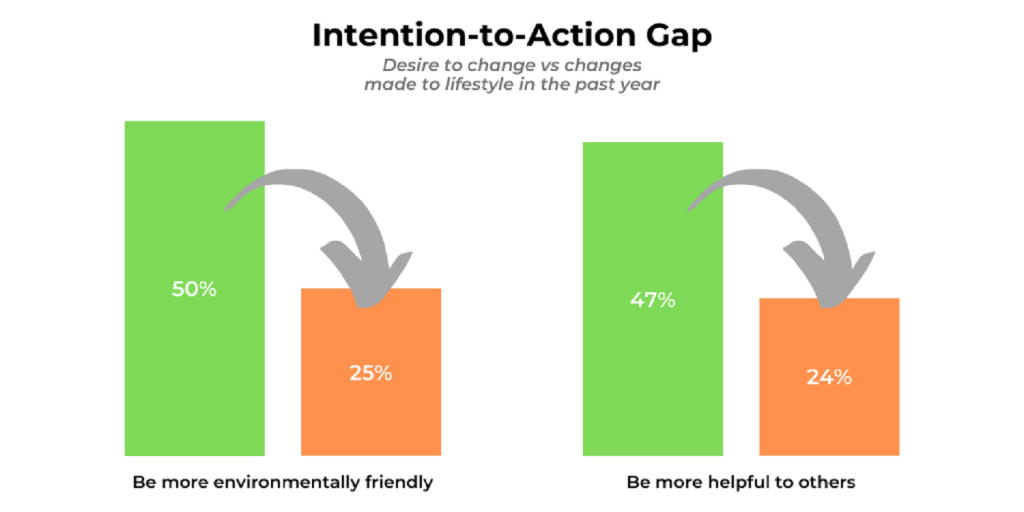

The Need to Tackle the Intention-to-Action Gap

Consumers express a strong interest in healthy and sustainable products, and an increasing minority is willing to pay more for them says EY. Sustainable purchasing trends are primarily driven by young people and those with families adds GlobeScan. However, Nielsen points out that the intention-to-action gap persists, with consumers facing barriers such as cost, access, and a lack of clarity regarding the environmental and ethical impact of their choices.

Kantar’s Sustainability Sector Index highlights practical barriers that contribute to the gap. These include the difficulty in discerning ethically sound products, uncertainty about where to find sustainable/ethical products, the perception that environmentally and socially beneficial products are more expensive, and the desire for clear certification explaining the environmental/ethical benefits that would influence purchasing decisions.

The recent cost-of-living crisis, as noted by Mintel and Kantar, has impacted consumer attitudes toward sustainability as well as limited the ability of ‘eco-conscious’ consumers to make sustainable choices. The trade-off between prioritizing sustainability and economic factors presents a significant obstacle, given that « sustainably marketed products cost 70% more than the category average price » according to Kantar.

Who’s in Charge of Catalyzing Change?

As pointed out in Ipsos Earth Day survey, global opinion is divided on when is the right time to invest in climate change, with 38% asserting that now is the right time and 30% claiming it is the wrong time. However, a majority agrees that the negative impact of climate change is close enough to worry about it (52% vs. 23%). Furthermore, the prevailing view is that the economic cost of climate change will be greater than the cost of measures to reduce it (42% vs. 26%).

Responsibility for action is seen across citizens (63%), government (61%), and businesses (59%) says Ipsos. The Who Cares Who Does study from Kantar challenges this view and points out a recent and notable shift in people looking towards governments, rather than companies or themselves, to champion the cause of the planet. Having said that, EY mentions that consumers still expect companies to demonstrate more leadership in reducing negative environmental impact.

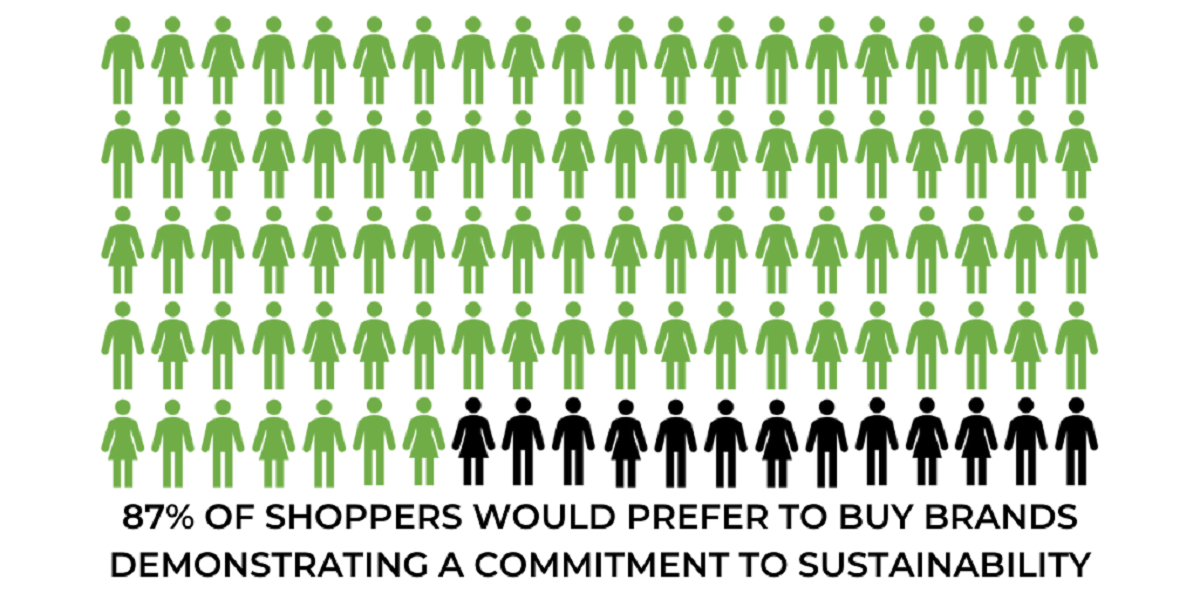

Brands and Retailers: Walking the Sustainability Talk

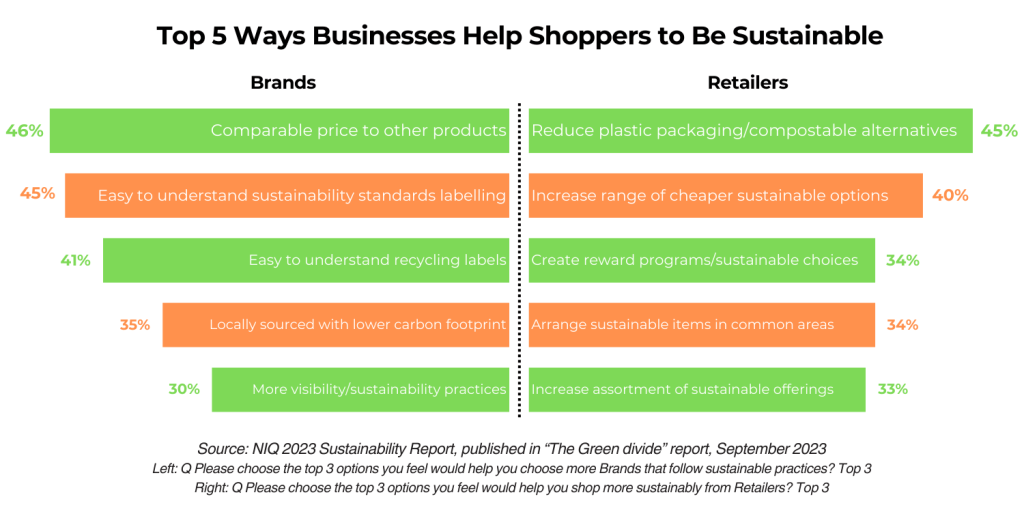

For Nielsen, consumers are calling for immediate action from brands and retailers to address sustainability issues and assist them in leading more sustainable lives. The top ways to contribute to help people be more sustainable is that brands can offer comparable prices and retailers reduce plastic packaging – note the latter is confirmed by the Kantar survey.

According to several reports, a barrier lies in a prevalence of false or misleading information about brands’ sustainable actions. For instance, 52% of people globally reported seeing or hearing false or misleading information about brands’ sustainable actions according to Kantar. Nielsen emphasizes that authenticity emerges as a crucial factor, with 77% of global consumers expressing zero tolerance for greenwashing. For certain groups, this intolerance reaches as high as 96%.

—–

In summary, we are experiencing a significant shift in awareness regarding the impact of climate change, with a growing realization from people of its tangible effects on their lives. However, and while there is a strong interest in sustainable living, a substantial gap still exists between good intentions and actual actions, driven by barriers such as cost, access, and a lack of clarity on sustainable products and practices. Economic constraints contribute to the challenge of adopting sustainable lifestyles, hindering widespread behavior change.

Consumers increasingly look towards governments and businesses to champion environmental causes – with a shift towards public authorities in recent times. Companies – brands and retailers in particular – can contribute by offering affordable and accessible sustainable options and reducing the economic barriers associated with eco-friendly choices. Meanwhile, states can play a role in encouraging sustainable behaviors through information and incentives.

It’s worth mentioning that greenwashing is emerging this year as a critical challenge, emphasizing the need for authenticity and transparency. Clear and substantiated communication from brands and retailers is crucial in helping consumers and shoppers make informed, sustainable choices, addressing the knowledge gap.

—–

PS: Unlike chatGPT, I provide my sources. You can read the reports by clicking on the links below:

EY Future Consumer Index (November 2023)

GlobeScan Healthy & Sustainable Living (October 2023)

Kantar – Sustainability Sector Index (October 2023)

Kantar Who Cares Who Does (September 2023)

Nielsen The Green Divide (September 2023)

Mintel Global Outlook on Sustainability (June 2023)

If you come across an insightful report which is not in the list, please send me a message through the contact form.